About That Income Tax

April 15, 2003

10 Outrageous Facts About the Income Tax

by Chris Edwards

Chris Edwards is director of fiscal policy studies at the Cato Institute.

As you struggle to prepare your taxes this year, you may take some comfort in knowing that your headache is being felt across the country. The following odd and outrageous facts show how widespread income tax problems are:

The U.S. "tax army" is bigger than the U.S. army in Iraq.

Income taxes are so complex that there are up to 1.2 million paid tax preparers in the country -- six times more than the number of troops in Iraq. The tax army includes legions of accountants, lawyers, and computer experts -- some of the best minds in the country. Unfortunately, their brainpower is adding little to the nation's standard of living.

A tax form for every special interest.

As the income tax grows more complex, the number of IRS tax forms has jumped from 402 in 1990 to 526 by 2002. Congress hands the accountants business on a silver platter when they create special interest tax forms such as "8845-Indian Employment Credit" and "8834-Qualified Electric Vehicle Credit." When Congress penalizes an activity, we get tax forms such as "6197-Gas Guzzler Tax." It's time to end the micromanaging and adopt a simple flat-rate tax. Until then, Congress needs to supplement "6478-Credit for Alcohol Used as Fuel" with form "XXX-Credit for Alcohol Used for Drinking."

Double-tax on dividends: 60 years and still not fixed.

Sixty years ago, a Treasury report noted that "double taxation of corporate profits is the principal problem raised in connection with the corporation income tax." In the 1930s, a Treasury report argued that the tax disincentive to pay dividends caused corporate management problems. Recent scandals proved them right. Congress should bite the bullet and reform dividend taxes now -- before the next round of corporate scandals begins.

Congress promotes discrimination through the tax code.

The front of the Supreme Court building boldly declares "equal justice under law," yet the income tax has hundreds of discriminatory provisions. For example, homeowners are treated more favorably than renters since they can deduct mortgage interest and other itemized deductions. Consider that a higher-income homeowner can effectively deduct car loan interest by shifting around his finances but a lower-income apartment dweller cannot. Americans would not stand for such discrimination on other taxes -- imagine if each shopper at Wal-Mart was assigned a different sales tax rate!

Congress on tax complexity: Who us?

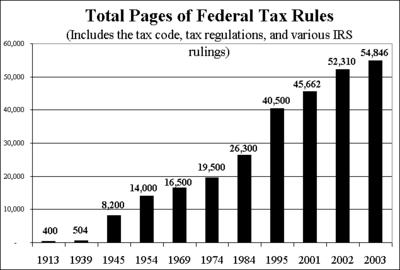

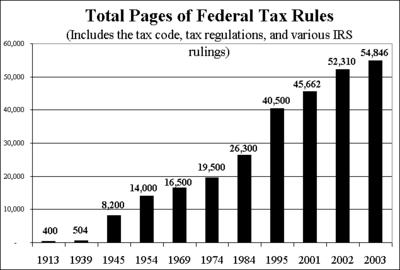

Congress frequently holds hearings on tax simplification so members can denounce the tax code's complexity. Each time, congressional experts and outside think tanks provide useful simplification ideas. Then when the TV cameras are turned off, Congress promptly ignores them and votes for more special interest breaks. The result: The number of pages in the tax code and regulations doubled from 26,300 in 1984 to 54,846 by 2003, according to tax publisher CCH.

AMT designed to catch 155 taxpayers will soon catch 37 million.

The alternative minimum tax is an unneeded parallel tax system alongside the ordinary income tax. It began life in 1969 after Congress was shocked (shocked!) to learn that 155 wealthy individuals were not paying tax because they used too many of the deductions that Congress had provided them. The AMT has been a complex nuisance ever since. But this dumb idea aimed at the rich is set to explode on the middle-class as the number of AMT taxpayers skyrockets from 3 million today to 36 million by 2010.

Voluntarism works for the U.S. military, not the income tax.

For years, officials have hailed the income tax as a voluntary system. The Treasury calls it "our voluntary tax system." The IRS says that it pursues "enforcement programs to promote voluntary compliance" and establishes "strategies to maximize voluntary tax law compliance by emphasizing customer satisfaction." But with 32 million IRS penalties assessed each year and about $10,000 in income taxes imposed on each taxpaying household, the tax isn't voluntary and these customers aren't satisfied.

Congress can't figure out how to measure "income."

Although the income tax is 90 years old, Congress still can't figure out how to measure "income." Some income such as municipal bond interest is not taxed, but other income such as dividends is taxed twice. The income tax treatment of savings is particularly incoherent and unstable. For example, there have been 25 major changes in the capital gains tax since 1922. The solution is to replace the income tax with a low-rate tax that exempts savings.

Family saving shouldn't require an advanced math degree.

Shouldn't saving for education, retirement, and other items be as simple as putting money in the bank? Instead, Congress has manufactured hundreds of special savings rules, such as for 401(k)s, Keoghs, deductible IRAs, nondeductible IRAs, education IRAs, Roth IRAs, traditional pension plans, annuities, SIMPLEs, SEPs, MSAs, and others. The IRS guide to IRAs alone is 105 pages long! President Bush's initiative to consolidate the savings plans and create a universal IRA would be a good step to bring some sanity to this mess.

Income taxes: A bad idea that got worse.

The income tax is not an example of a good idea gone bad. It was bad from the beginning, and it just keeps getting worse. The income tax distorts financial planning and business investment, and it encourages tax avoidance and evasion. Because the income tax is built on an unworkable base of "income," the law is continually changing. Let's simplify Americans' finances and disband the tax army by pursuing fundamental tax reform.

Cato Institute

10 Outrageous Facts About the Income Tax

by Chris Edwards

Chris Edwards is director of fiscal policy studies at the Cato Institute.

As you struggle to prepare your taxes this year, you may take some comfort in knowing that your headache is being felt across the country. The following odd and outrageous facts show how widespread income tax problems are:

The U.S. "tax army" is bigger than the U.S. army in Iraq.

Income taxes are so complex that there are up to 1.2 million paid tax preparers in the country -- six times more than the number of troops in Iraq. The tax army includes legions of accountants, lawyers, and computer experts -- some of the best minds in the country. Unfortunately, their brainpower is adding little to the nation's standard of living.

A tax form for every special interest.

As the income tax grows more complex, the number of IRS tax forms has jumped from 402 in 1990 to 526 by 2002. Congress hands the accountants business on a silver platter when they create special interest tax forms such as "8845-Indian Employment Credit" and "8834-Qualified Electric Vehicle Credit." When Congress penalizes an activity, we get tax forms such as "6197-Gas Guzzler Tax." It's time to end the micromanaging and adopt a simple flat-rate tax. Until then, Congress needs to supplement "6478-Credit for Alcohol Used as Fuel" with form "XXX-Credit for Alcohol Used for Drinking."

Double-tax on dividends: 60 years and still not fixed.

Sixty years ago, a Treasury report noted that "double taxation of corporate profits is the principal problem raised in connection with the corporation income tax." In the 1930s, a Treasury report argued that the tax disincentive to pay dividends caused corporate management problems. Recent scandals proved them right. Congress should bite the bullet and reform dividend taxes now -- before the next round of corporate scandals begins.

Congress promotes discrimination through the tax code.

The front of the Supreme Court building boldly declares "equal justice under law," yet the income tax has hundreds of discriminatory provisions. For example, homeowners are treated more favorably than renters since they can deduct mortgage interest and other itemized deductions. Consider that a higher-income homeowner can effectively deduct car loan interest by shifting around his finances but a lower-income apartment dweller cannot. Americans would not stand for such discrimination on other taxes -- imagine if each shopper at Wal-Mart was assigned a different sales tax rate!

Congress on tax complexity: Who us?

Congress frequently holds hearings on tax simplification so members can denounce the tax code's complexity. Each time, congressional experts and outside think tanks provide useful simplification ideas. Then when the TV cameras are turned off, Congress promptly ignores them and votes for more special interest breaks. The result: The number of pages in the tax code and regulations doubled from 26,300 in 1984 to 54,846 by 2003, according to tax publisher CCH.

AMT designed to catch 155 taxpayers will soon catch 37 million.

The alternative minimum tax is an unneeded parallel tax system alongside the ordinary income tax. It began life in 1969 after Congress was shocked (shocked!) to learn that 155 wealthy individuals were not paying tax because they used too many of the deductions that Congress had provided them. The AMT has been a complex nuisance ever since. But this dumb idea aimed at the rich is set to explode on the middle-class as the number of AMT taxpayers skyrockets from 3 million today to 36 million by 2010.

Voluntarism works for the U.S. military, not the income tax.

For years, officials have hailed the income tax as a voluntary system. The Treasury calls it "our voluntary tax system." The IRS says that it pursues "enforcement programs to promote voluntary compliance" and establishes "strategies to maximize voluntary tax law compliance by emphasizing customer satisfaction." But with 32 million IRS penalties assessed each year and about $10,000 in income taxes imposed on each taxpaying household, the tax isn't voluntary and these customers aren't satisfied.

Congress can't figure out how to measure "income."

Although the income tax is 90 years old, Congress still can't figure out how to measure "income." Some income such as municipal bond interest is not taxed, but other income such as dividends is taxed twice. The income tax treatment of savings is particularly incoherent and unstable. For example, there have been 25 major changes in the capital gains tax since 1922. The solution is to replace the income tax with a low-rate tax that exempts savings.

Family saving shouldn't require an advanced math degree.

Shouldn't saving for education, retirement, and other items be as simple as putting money in the bank? Instead, Congress has manufactured hundreds of special savings rules, such as for 401(k)s, Keoghs, deductible IRAs, nondeductible IRAs, education IRAs, Roth IRAs, traditional pension plans, annuities, SIMPLEs, SEPs, MSAs, and others. The IRS guide to IRAs alone is 105 pages long! President Bush's initiative to consolidate the savings plans and create a universal IRA would be a good step to bring some sanity to this mess.

Income taxes: A bad idea that got worse.

The income tax is not an example of a good idea gone bad. It was bad from the beginning, and it just keeps getting worse. The income tax distorts financial planning and business investment, and it encourages tax avoidance and evasion. Because the income tax is built on an unworkable base of "income," the law is continually changing. Let's simplify Americans' finances and disband the tax army by pursuing fundamental tax reform.

Cato Institute

![[Link to THOMAS Home Page]](http://thomas.loc.gov/images/link.gif)

27 Comments:

This comment has been removed by a blog administrator.

Georges Seurat must have provided the artistic inspiration for all modern legislation, in both the development of the federal budget and our tax code...

Yep, another modern idea given roots... "death of a thousand tax-cuts, er... dots, er... cuts"

...and then culturally watered by the likes of Stephen Sondheim "Sunday in the Park with George".

Henry George's "Single Tax" sounds like a pretty good idea in retrospect... Maybe that's where the idea for a single "Flat tax" came from?

-FJ

Before I delete the anonymous post from Kim someone give me a second opinion. The post looks like Blog spam to me. I eliminated one yesterday and I am still thinking about the Corvette post.

Here's one for you, and it really happened.

My mother, rest her soul, worked as an IRS statistician and worked her way up to supervising the auditors in an office in the main IRS building in D.C. One of her clerks asked, seriously, "Are there 100 cents in a dollar?"

No wonder it takes so many employess to run the IRS!

My vote = delete it. I don't click on things like that.

BB,

I defer to your discretion and judgement as host. I know that one has to attract "readers" to blogs "somehow" and pay their IP and Hosting bills "somehow". You can attempt to create a "commercial free zone", but then it will take "force" to maintain that "value".

And you know how mr. ducky squawks every time you seek to impose YOUR values or "laws" on him... but I'm sure that since its' against those blitz advertisers and capitalists bearing skunk-like stripes, he'll be fine with it. Imposing one's own values on "others" is fine when they're your own values. It's when they impose them on you, that the rub begins to burn and squawks begin. And mr.ducky hates free and natural markets. Me, I simply hate "marketers" who are so unintelligent that they need to spam. But there we have it, another unintelligent approach slapping paint on canvas with broad strokes this time. At least Seurat's dots were "finely" and "artfully" applied. Not like Pollock's unintelligible blobs and drips.

-FJ

Sometimes the geometric shapes and bright colors fascinate Big Bubba, but it is not really my thing.

My artists are Renoir, Van Gogh, Gauguin, Monet, Cezanne, and Picasso. In this hemisphere I am very fond of Diego Rivera and Frida Kahlo.

I know that the post on this thread from Kim is spam. My intention in asking for input is some involvement before I delete it. Prior to the Blog spamming on my site I had just read a tech article about Blog spammers and their goals.

OK, Kim, out you go.

Mr. Ducky, Big Bubba also does not want you to get bogged down in the Cato Institute. You know what they say about a little knowledge being a dangerous thing. We certainly would not want a dangerous duck lurking on this site.

How about that Money 101 website? I don't think there would be anything to fear about your learning what FICA tax and payroll deductions for income tax are all about. Have you been there yet?

I don't "ban" Pollock. I simply relegate his "purer", more "art-less" "natural", and "simpler" style nearer the ending point of my canvas just as I relegate pure chaos and anarchy to the "outside" fuzzy "impressionistic" edges of the cultural form "boundary" that defines my first principle of "civilizational art". If I want purer forms of "chaos" in my painting, all I need to do is observe what is going on outside the painting's "frame"... that is, if it were hung in a natural environment like the wall of some post-modern cultural "caveman's" den (AKA - you're apartment) and not MY "civilizational" museum.

For order and understanding is what I, as mock-lawgiver, and civilizational citizen am trying to "create" in the picture, as my "object" of beauty. As Aristotle noted "The same attribute cannot at the same time belong and not belong to the same subject and in the same respect".

And so I "slam" Pollock as a creator of "culture", not "civilization". His style is essentially "civilization's" opposite.... degeneration into culture. The dripped "lines" in "Blue Poles" represent (at least to me) that he hasn't reached "pure" chaos boundary yet... and so he might still reside within the fuzzy cultural boundaries of my civilizational painting, but I suspect he should be relegated to a position closer to the less "thoughtful" "outer-most" edges on the right (if the right represents a "temporal" progression).

And so I favor symmetry, proportion, measure, and a geometrically "curved" truth generated by adherence to said "artistic" first principle, for it brings me "closer" to my object... "pure" thought. I know I cannot attain my "pure" object (or it's closest relation... a duty born of complete freedom resulting in complete self-control in contemplation of G-d in action), for it would "kill" me, but I also know that Pollock's art distances me from it.

In other words... the baroque style lies closer to the "center" of my canvas and "taste"... but I cannot "know" the center of my canvas. For that beauty which has "created" order and chaos must have attributes "different" from both.

Plato's sign at the "Academy" - "Let none who know not geometry enter".

btw - I do like Mondrian's art, and would place it much closer to my center than Pollock. The "proportions" and "symmetries" are a little out-of-whack, but the "subject" agree's with me (what little I've seen). I'm not quite sure which "quadrant" of my picture I would place him in, possibly upper-right.

-FJ

Ooops, I forgot to add. You can "appreciate" BOTH artists and all artists. But one should not "dwell" on the "thoughtful" contemplation of anything too far from the painting's center, lest one should begin to unintentionally drift and steer one's course in that direction. Best tie yourself to the mast, and plug your crews ears with wax. The siren's song is sweet, but not meant for all to hear, Ulysses.

-FJ

mr. ducky,

What lies at the heart of your painting?

-FJ

where did yoy get the metter?

post-visual note to ducky...

And what lies at the paintings center cannot be "seen" with the eyes. At best, one should "listen" to it... music... to words... to "soul".

-FJ

Myron, I believe that you can click on the meter to go to www.sitemeter.com. Otherwise, you know the drill. It's a great freebie upgradeable to premium for a fee. I checked out your blog. Come back again.

"Academy" - "Let none who know not geometry enter"

I received a C+ in HS geometry. It is the only math success of my life. Algebra was my demise at A&M. That was back in the day when instructors, geeks, and nerds wore slide rules the size of mountain howitzers in their hip holster.

I would prefer Mondrian over Pollack. I will admit that I don't remember knowing anything about them until this current discussion.

I meant to ask the Duck if his degree was in Fine Art at Snooper's Bunion or whatever the name of his effete easterner boutique school is that he attended.

I have been asking him for years, to no avail, if he ever served in the military.

There is very little painting I don't like, or at least admire. But Pollock always struck me as one of the first modern art world "sensation" fashion shams. I just have never been able to appreciate, much less like, what he does, and I can't believe his painting will stand the test of time.

I do think Mondrian was an important artist. My favorite painter (though I don't really play favorites) is Vermeer, which I suppose is typical, but then there's really nothing wrong with citing Bach as your favorite composer. Vermeer somehow strikes me as encapsulating all of painting, at its most figurative and prediction its most abstract (look at one of his milk pitchers--blow it up and it'd be an early 20th century masterpiece. His work is pious and subversive, classical and Zen all at once. And he did all this with such a miniscule body of work.

Norm, would anyone turn down the opportunity to own an Old Master's work? I still like my list. I think Pollacks colors are rather dark for my tastes. Mondrian is OK since I have always liked bright geometric art.

I must be losing my touch. I don't even seem to be able to bait the Duck anymore. By the way, Mr. Ducky, my real infatuation is with Frida, not Diego. San Antonio continues the Mexican mural tradition. We have murals everywhere including on the walls of public housing.

Ducky

I have my own blog and Gaza is of zero stategic value. Let it become a pest hole . FYI why dothe fake indigenous people have rights to make Judenrhein land.

When you want to know about ethnic cleansing google the population of India and Pakistan,Turkey, Jordan.

FYI I have scores of Christians fleeing Syria, Egypt and Bangladesh

tell me if that small mind sees a pattern.

mr. ducky,

Ouch! You must get freezer burn living just above the tree-line atop Mt. Olympus. You're staring too hard towards the line dividing the visual and geometric from the very center, where beauty lies. I think you've found the eternal, but virginal masculine, but left the eternal but fertile feminine somewhere behind. The "baroque" period suffered from an over-rich fullness that literally spills out onto the canvas. The abstracts seem to suffer a bit from under-nourishment, and I don't think even a Spartan could survive. Has our sun gone nova?

But it is extremely rich in symbolism... demonstrating an intellect far too superior and focused for my own personal taste (especially Mangold!). Its either like staring into the sun (way too brilliant), or in Martin's case...the moon (way too subdued). But relatively "sterile", IMO, in both cases.

I guess I always will be a country boy at heart. Not enough food grows in the city.

-FJ

norm,

I like Vermeer too. It's hard to criticize his skill, technique, or subject except perhaps to say they could use a little more "courage" or "nature" for contrast. Perhaps a paradoxical lion should sit in the corner of his rooms... or perhaps a buzzard on a stand?

-FJ

BB,

I liked Rivera better than Frida (Los Viejos, Las Ilusiones, the doctors hands). I think I found Frida a little too self-absorbed and somehow "resentful". I think the pair painted with a little too much "disillusionment" and were too pessimistic. Perhaps a "vacation" could have cheered their spirits and allowed them to occassionally embrace life and beauty. Even Frida's "hopes" of Nirvana were rather gloomy. Their "technique" could have used a little work as well.

-FJ

Farmer John, I have more interest in Frida's life story. I do find her work interesting.

"I never knew I was a surrealist till Andre Breton came to Mexico and told me I was." --Frida Kahlo

Samwich,

What kind of flies do you use when you fish for Brownies, dry or wet? And what colors work best for you?

Brookies are my favourite, so far. I've never caught a Brownie.

-FJ

Thanks Samwich, wonderful primer and discourse. I need to start getting out again. I'll bet you put the kids of at least one Orvis executive through college.

-FJ

Post a Comment

<< Home